Interesting Times It’s mid-2025. We’ve had a federal election, USA election, a big storm that shut down southeast Qld (reminiscent of COVID 5 years ago), government policy announcements includin[...]

At age 94, Warren Buffett officially announced he is stepping down as CEO of Berkshire Hathaway, marking the end of an extraordinary era in investing. Revered for his wisdom, discipline, and long-te[...]

The $3M Super Tax was previously blocked in Senate by a few independents, but it’s now back on the table post the election and the Government has a voting majority in both houses of parliament. Wh[...]

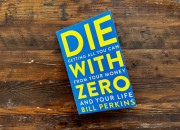

What if living life to the fullest wasn’t just an Instagram motto but a financial strategy? In Die with Zero, Bill Perkins flips conventional wisdom on its head, arguing that saving too much is just[...]

Cost of living and persistent inflationary pressures look to continue. If so, this will lead to continued cautious monetary policy and sustained ‘higher’ interest rates in Australia (despite exper[...]

2024 was the year of political shake ups with 4.4 billion people voting in 75+ countries. In the US, perhaps a surprising result with Donald Trump winning in a landslide (predicted by the bookies but [...]

The 2024/25 Federal Budget was announced on 14th May 2024 with the stated aim to assist with cost-of-living pressures and stimulate growth over the long-term. There were no surprises given most of the[...]

After a strong finish to 2023, equity markets continued to push new highs in 2024 on the hope interest rates would reduce earlier than expected. By mid-April sentiment changed to cool the run on the b[...]

The 4th anniversary of COVID is weeks away and 2023 has been eventful. We’ve seen a new war in addition to Ukraine, significantly higher prices of goods & services, inflation at 30+ year highs[...]

The hot topic right now is the combined housing and cost of living crisis in Australia. Property prices, inflation and interest rates move in cycles and as they move higher, we see a widening gap [...]