To ensure clients continue to get optimal investment outcomes we are continually seeking out reliable research and in the last few months the 30 June 2014 SPIVA Scorecard was released. This is a regular paper which compares the historical results of Australian and international actively managed investments to benchmark returns.

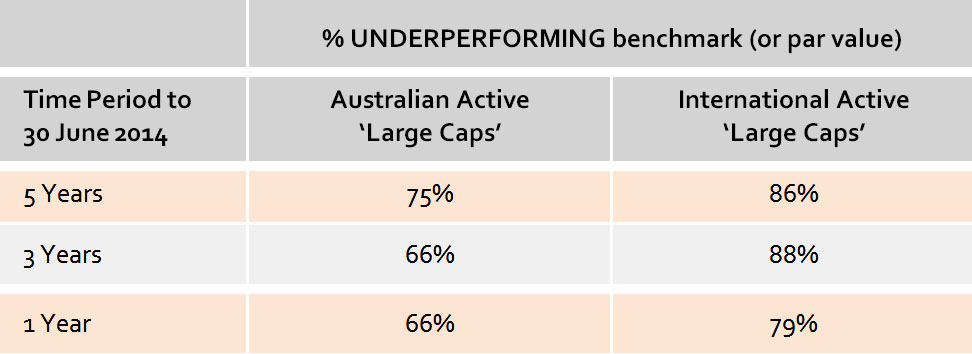

In the latest report the evidence continues to highlight a significantly large % of actively managed Australian and international portfolios underperforming benchmark indices (S&P / ASX 200 accumulation index and MSCI World Ex Australia respectively) as follows:

The research results reaffirm:

- The difficulty professional managers/brokers/experts face in continuously needing to identify the right company, the right time to buy and then the right time to sell. Predictions are easy to make, but the proof is always in the pudding. It takes a lot of effort to earn a dollar after tax (with the top tax rate now 49%) so there is no place for investment speculation.

- The typical active investment manager has an expense ratio of 1% per annum. This adds extra weight at the start of every year which means the manager has to outperform by 1% to simply get the benchmark return and that’s a real handicap.

- Investors almost always win (and achieve their goals) by capturing the market (or benchmark return) if they can stay disciplined to a well thought-out strategy and invest regularly.

Did you know the Australian benchmark returns to 30 June 2014 were 8.8% pa for 10 years (including the downturn in the GFC) and 9.4% pa for 20 Years? Inflation over the same period was 2.6% and 2.7% respectively.