Interesting Times

It’s mid-2025. We’ve had a federal election, USA election, a big storm that shut down southeast Qld (reminiscent of COVID 5 years ago), government policy announcements including tariffs igniting trade wars, new age drone warfare and cyber war (scams) too often in our personal email and SMS messages. The speed of change is accelerating, but, in Australia, it seems the expansionary policies of a big spending Government combined with higher immigration (into Australia) will continue. These forces combined with relentless increases in power prices +7% (+ solar feed in tariff cuts), insurance +8% (weather events), increases to the Australian minimum wage (now highest in the developed world) and falling economic productivity unfortunately makes Australian enterprise relatively less competitive. Meanwhile, our real estate valuations continue to climb the list of the most expensive in the developed world.

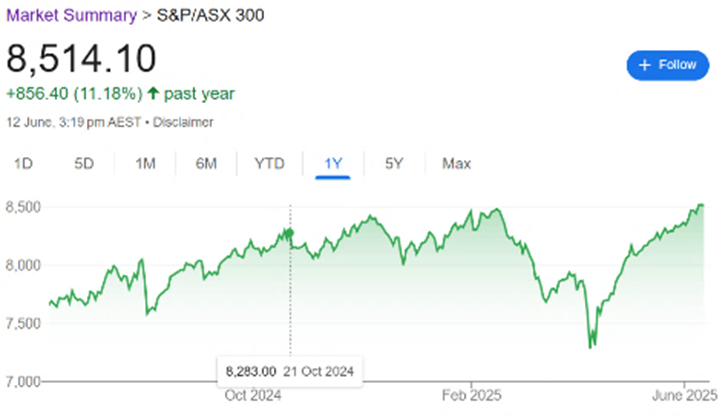

Countering these factors, businesses of all sizes are rapidly implementing new technology (AI) to automate voice/email/data traffic, eliminating large numbers of humans and reducing labor costs (an upcoming social & economic challenge). This trend maintains the market dominance growth of the world’s largest technology companies (eg Microsoft, Alphabet, etc). The upshot of these combined factors has made for interesting times in equity markets, recording new highs in February 2025 to then fall 15% (with fear of Trump & trade wars in a few short weeks) to then reclaim new highs mid-June 25.

The ASX300 has returned +12% and S&P500 +13% for FY25 so far. The RBA has cut interest rates twice in FY25 with rates now at 3.85%. This has made cash deposits relatively less attractive, with 1 year term deposit rates falling from highs of 5% last year to 4% today. This extreme market volatility (recently triggered by ‘political tweets’) has reinforced the need for a steady hand at the wheel, avoiding the temptation to ‘time markets’. Had an investor tried to ‘pick the bottom’ of April’s tariff-led market dive, they had a 3-day window of opportunity to pick the low point. These endeavors are completely unnecessary to achieve successful investment results. In other news, the ongoing creep of complexity in superannuation rules continues (see separate article regarding the worrying proposal to tax unrealised gains without threshold indexation). As always, we welcome your call if you have any questions on your finances. Otherwise, we look forward to seeing you again soon.