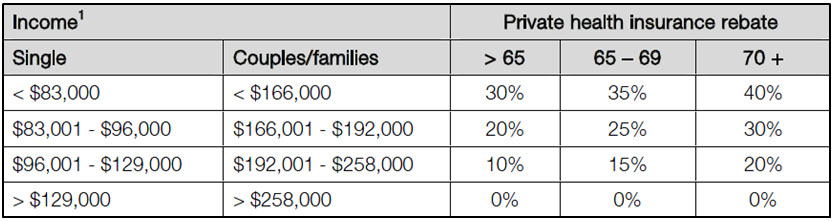

Currently individuals and families who hold private health insurance generally receive a 30% Government rebate on the premiums. From 1 July 2012 the eligibility for this rebate will be income tested and singles earning over $83,000 pa and couples/families earning over $166,000 pa will receive a lower rebate (refer table 1).

Table 1 – Changes to Private Health Insurance Rebate

For those earning above the income thresholds this will have the effect of increasing their private health insurance premiums by 14% – 43% (assuming premium rates remain unchanged).

This will have a significant cost impact for many households however the costs of not holding this cover may still outweigh the increased premiums from 1 July 2012. Before changing your cover levels we suggest you consider the following:

- Current and potential health issues – private health insurance premiums are not influenced by prior medical records so those more likely to claim are potentially going to receive greater value from their cover.

- Personal preferences – for private health care and choice of doctor.

- Extras cover – for non-Medicare related treatments such as dental and physiotherapy.

- Lifetime Health Cover – a premium loading of 2% will apply for each year a person is aged over 30 and does not hold private health insurance up to a maximum of 70%.

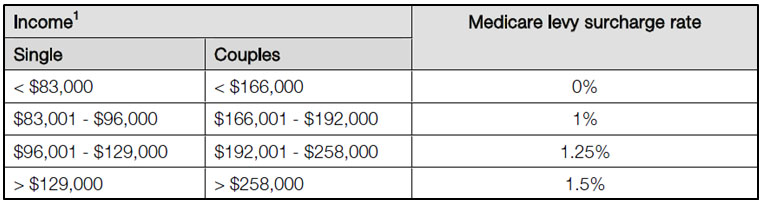

- Medicare Levy Surcharge – singles earning over $96,000 and couples/families earning over $192,000 who do not have appropriate insurance are required to pay a surcharge. From 1 July 2012 the surcharge is increasing (refer table 2)

Table 2 – Increase to Medicare Levy Surcharge (in addition to Medicare Levy)

1. Income defined as taxable income, exempt foreign income, reportable fringe benefits, total net investment losses and reportable superannuation contributions.