In recent years we have seen contrasting investor profiles of those who are waiting for good news before continuing their regular savings strategy and those who have maintained the discipline of staying the course who have obtained dramatically different results.

Investing regularly (e.g. monthly) means purchasing through the market cycle when values are high and low, averaging the purchase price over time. This strategy is an alternative to timing the market. In the last 5 years when things have been risky and uncertain staying the course and investing spare savings to avoid an overweight position in cash has made a significant difference to investor returns.

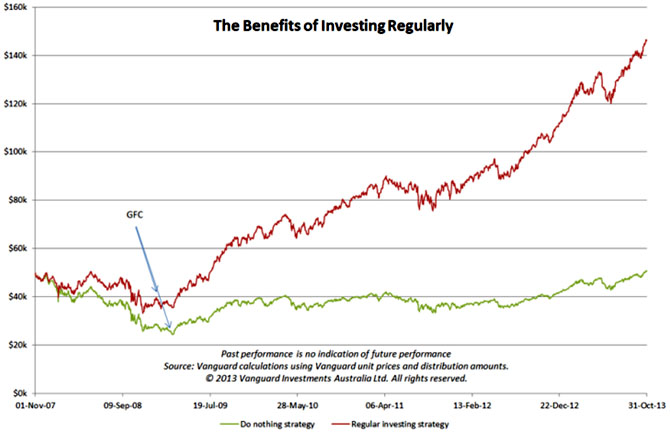

To highlight the benefit of investing through tough times with a starting investment of $50,000 into the largest 300 ASX listed companies at the height of the market at 1 November 2007 (ASX200 6829) prior to the GFC (i.e. the 50% correction), the resulting total return on 1 November 2013 would be significantly different depending if you:

- Waited for things to improve making NO new investments -> you would have earned a total return of 1.4%; or if you

- Invested $1,000 per month every month for 6 years -> you would have earned a total return of 20.8%.

Both scenarios include dividend reinvestment, but exclude franking credits and the chart illustrates the results below.