Consistent with tradition, on the second Tuesday in May the Government released its 2012 Federal Budget. Some of the key announcements are summarised below. Please note many of these changes are still to be legislated and we will keep you informed of any relevant changes over the coming months.

Deferral of Higher Concessional Contributions for Over 50’s

The proposal of allowing individuals aged over 50 and with a superannuation balance less than $500,000 to make up to $50,000 in concessional contributions each year has now been deferred to 1 July 2014. This means the concessional contribution cap for all individuals (including those aged over 50) will reduce to $25,000 from 1 July 2012. If you exceed this limit the top marginal tax rate of 46.5% will apply on the excess contributions.

30% Contribution Tax for Higher Earners

The Government plans to increase the tax payable on concessional contributions to 30% for individuals earning over $300,000 p/a (tax rate currently 15%). The $300,000 includes salary, bonuses, net investment losses and concessional super contributions.

Superannuation Guarantee Increase

The compulsory employer superannuation contribution (SG) rate will remain at 9% for another year then increase to 9.25% from 1 July 2013 (FY2013/14).

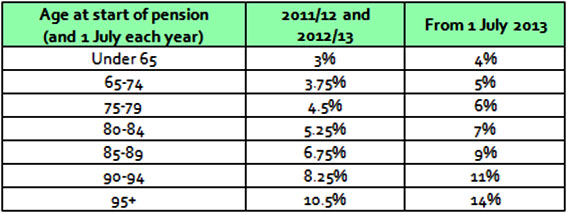

Minimum Pension Drawdown Relief Extended

The reduced minimum pension drawdown relief will continue for superannuation pension withdrawals for another 12 months before reverting to “standard” levels from 1 July 2013.

Net Medical Expenses Tax Offset (NMETO)

For people with adjusted taxable income above $84,000 for singles and $168,000 for couples/families in 2012-13, the threshold above which a taxpayer may claim NMETO will be increased to $5,000 (up from $2,060 currently) and indexed annually. The rate of reimbursement will be reduced to 10% (down from 20%) of eligible out of pocket expenses.

SchoolKids Bonus

A cash payment of $820 for each child in high school and $410 for each child in primary school will automatically be paid to parents who are eligible for Family Tax Benefit Part A. The first payment is expected in June 2012. This will replace the Education Tax Refund.

Family Tax Benefit Part A

Eligibility for FTB Part A will be limited to families with children under 18. The base rate will increase by $100 p/a for families with 1 child or $200 p/a for families with 2 or more children. The maximum rate will increase by $300 p/a for families with 1 child or $600 p/a for families with 2 or more children.

Company Tax Rate Unchanged

The proposed reduction in the company tax rate is not going ahead. The tax rate will remain at 30%.

Carry Back of Tax Losses

From 1 July 2012, companies will be able to ‘carry-back’ losses to prior years. For example, if a company makes a profit in year 1 and pays tax, but then make a loss in year 2, the company can get a refund of the tax paid in the previous year.

The measure will be restricted to losses of up to $1M. Losses incurred in the 2012/13 financial year can only be offset against profits from the previous year, thereafter losses will be able to be carried back 2 financial years.

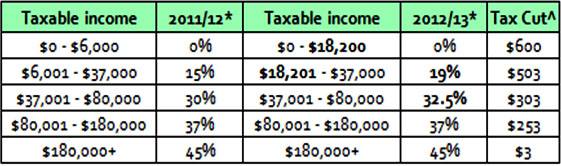

Changes to Marginal Tax Rates

The personal taxation rates will change from 1 July 2012 as part of the Clean Energy (Carbon Tax Relief) Package benefitting lower income individuals only:

* Excludes Medicare Levy of 1.5%.

^Estimate only, includes proposed changes to Low Income Tax Offset.