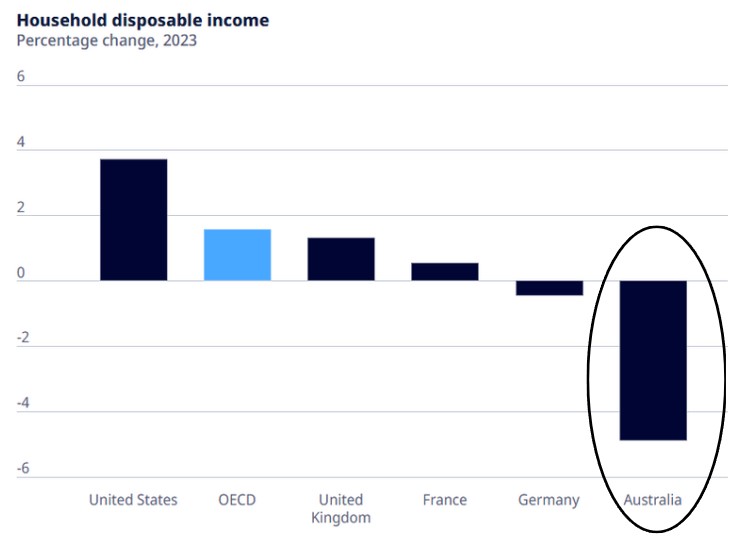

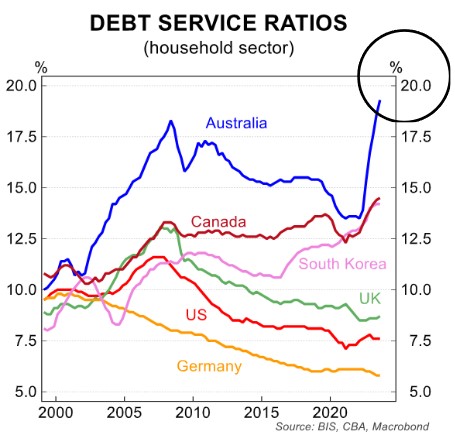

Cost of living and persistent inflationary pressures look to continue. If so, this will lead to continued cautious monetary policy and sustained ‘higher’ interest rates in Australia (despite expert predictions rates were going to be cut in early 2024). Will big spending government programs continue with additional giveaways in the upcoming election due by May 2025? Will “temporary” cost of living rebates on electricity and registration be extended? Can we turn falling economic productivity around? Will changes to the RBA Board structure in March 2025 impact on setting future Monetary Policy? The unfortunate reality is Australia’s economic report card shows significant increases in household debt and the largest yearly decline in disposable income compared to other nations which means declining Australian living standards.