The 2013 budget was largely as expected. The key proposals are summarised below and subject to being legislated (and/or possible change post the next election).

Increased Concessional Contribution Cap

The current concessional (tax deductible) contribution cap is $25,000 per financial year for all ages. The cap is proposed to increase to $35,000 for those:

- Aged over 60, effective 1 July 2013; and

- Aged over 50, effective 1 July 2014.

Proposed Tax on Pension Assets

From 1 July 2014 it is proposed that all earnings (income including franking credits and capital gains*) on assets supporting a superannuation income stream (pension) will be tax free up to a maximum of $100,000 per financial year, with any earnings above this being taxed at 15%.

*Note capital gains realised on assets purchased before 4 April 2013 will not be included in this new tax. There are complex phase-in rules we will talk to you about where relevant.

Medicare Levy to Increase

The Government proposes to increase the Medicare Levy from 1.5% currently to 2.0% from 1 July 2014 to raise funds for DisabilityCare Australia. This will raise the highest tax rate to be 47% on taxable income greater than $180,000.

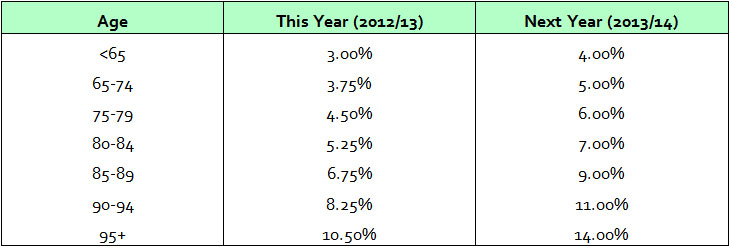

Minimum Pensions to Increase from 1 July 2013

The minimum pension drawdown relief (introduced during the GFC) phases out on 30 June 2013. As a result superannuation pension accounts are going to have higher minimum withdrawal limits next financial year due to a higher statutory withdrawal percentage combined with higher member balances following a period of strong market performance in FY13.

Minimum Pension Withdrawal Limits

Net Medical Expenses Tax Offset Abolished

The net medical expenses tax offset will only be available in the 2013/14 financial year for those who claimed the offset in the 2012/13 financial year and meet the relevant thresholds.

Self-Education Expenses Deduction Cap

From 1 July 2014, taxpayers will be able to claim a tax deduction for eligible education expenses up to a maximum of $2,000 per financial year.

Refund of Excess Contributions

Currently amounts contributed to superannuation in excess of the concessional contribution cap are taxed at 46.5%. From 1 July 2013 excess contributions will be taxed at the individual’s marginal tax rate plus an interest charge. Also there will be the ability to withdraw the excess contribution from superannuation.

HECS-HELP and HELP Bonus Abolished

From 1 July 2014 eligible students will no longer receive a discount if they pay their fees up-front or repay their HELP debt early.